IDFC and IDFC First Bank - reverse mergerIDFC holds a significant portion of IDFC First Bank as a bank HoldCo. IDFC has no other purpose of existing and hence we might see a reverse merger where shareholders of IDFC receive shares of IDFC First Bank or the shares are sold and the proceeds are returned to the shareholders of IDFC.

Search in ideas for "IDFC FIRST"

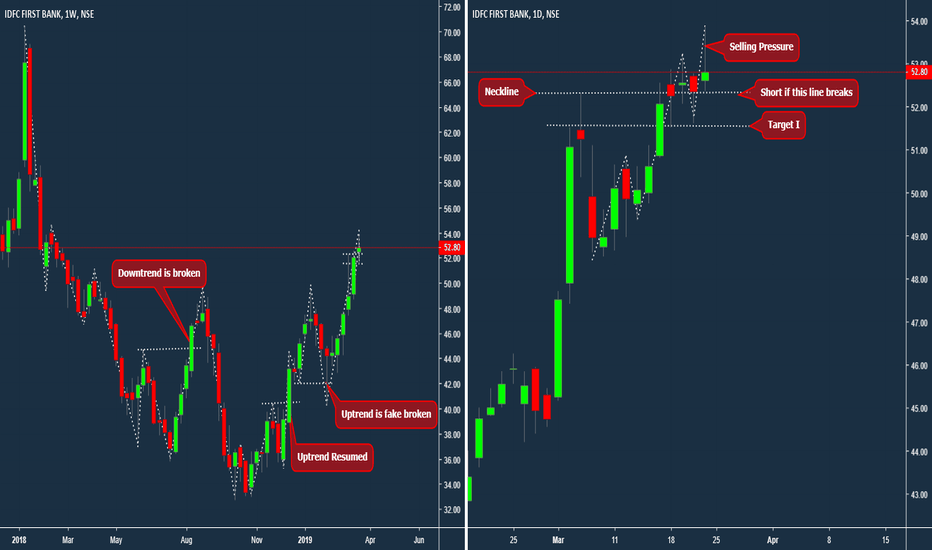

Descending triangle breakout in IDFC First BankChart -> IDFC First Bank Daily

IDFC First Bank has given a Descending Triangle breakout with volume.

CMP: 57

Good range: 54 to 56

Targets: 61, 64

SL: 53.50 daily close

Disclaimer: This is for educational purposes only, not any recommendations to buy or sell. As I am not SEBI registered, please consult your financial advisor before taking any action.

Stock Alert: IDFC First BankPotential breakout in the making!

IDFC First Bank is showing a flag and pole pattern on the weekly timeframe, which indicates a strong continuation signal. This pattern generally forms after a sharp price move (the "pole") followed by a consolidation phase (the "flag"). We are now approaching a potential breakout point.

🔍 Key Highlights:

Pattern: Flag and pole

Timeframe: Weekly

Potential breakout zone: Trendline

Volume activity: Watch for a volume surge during the breakout.

If this breaks out, we could see strong upward momentum. Keep an eye on this stock!

Sell IDFC First Bank Target 176The analysis of the IDFC First Bank chart indicates signs of exhaustion, suggesting that the stock has reached the top of its daily and weekly Upper Band. This could be an indication that the stock's upward momentum may slow down or even reverse in the near future. Additionally, the Max Pain level, which represents the strike price at which option buyers would incur the maximum loss, is at 176. This further supports the idea that profit booking could be on the horizon, as investors may consider taking profits or reducing their exposure to the stock. It's important to note that this analysis is based on technical indicators and historical data, and further research and analysis are recommended before making any investment decisions.

📊 IDFC FIRST BANK At Breakout 🎯NSE:IDFCFIRSTB

As one can see on the chart that IDFC FIRST BANK share at breakout level if we will get breakout then we might see target as mentioned on chart.

******whatever charts or levels sharing here are just for educational purpose only, not a recommendation. Please do your own analysis before taking any trade on them. We are not SEBI registered.

IDFC First Bank very very interesting! Okay, this is for long term investors. If you are not a long term investor, the idea might not interest you but please continue to read and let me know what you think. :)

So, let's talk trend-lines first.

On Monthly charts, the stock is showing an up trend formed by higher highs and higher lows, well barring one red candle.

Also, there is another trend-line where the stock took support before. I have marked each of those attempts that acted like support.

If we were to go by the bookish definition of support and resistance, "a support line becomes a resistance".

Now, what is that actual idea?

Honestly, i feel fundamentally the bank has turned a corner. It has made an attempt to increase the retail customers over corps/institutions. While I would encourage you to read how that's good for a bank, I would just say in short - "lower the numbers to insti/corps, lower are chances of NPAs increasing". It is posting good results and has shown signs of being on the way up. I am going to mention a few levels below which are crucial. But if this crucial level is broken, this is a stock to GO LONG!

What levels are crucial?

I would say 35.75-36 are very crucial levels for the stock. If it gives a close on Monthly Charts above this level, then this could be a multi bagger at these levels.

NSE:IDFCFIRSTB

Give me a follow and like. :)

Happy Diwali to you all.

IDFC First Bank - BreakoutHello All,

Greetings!

IDFC Bank Shows Breakout

it has been very clear that IDFC Banks Chart shows clear breakout from from Downtrend Triangle Pattern.

Important Things

1. This is only for educational purposes only.

2. Never over trade.

3. Always keep Stop Loss.

4. Trade in limited quantity.

5. Taking a small loss is better than wiping up your capital.

I hope you found this idea helpful.

Please like and comment.

Share with Your Friends.

Keep Learning,

Happy & Safe Trading

IDFC First Bank - Confluence of factorsMarkets are a bit soft - so putting on small position makes sense. However there is a huge confluence of factors for IDFC (including MSCI inclusion) - wait for markets to turn and this could be first out of the gate

Watch the video to see key reasons why - please feel free to post comments / diasagreements etc

IDFC at bounced from an important pivot? Move up to continue?IDFC FIRST BANK: The stock has taken support at multiple pivots and bounced with strength. The momentum is positive as shown by MACD as it is above the zero line in positive mode. The RSI is displaying strength above 50 levels on the daily charts. A strong close above 43 will be very positive with stock and it can move to 46 levels. A move below 40.50 will not be favorable for being in long positions.